The objective of the application form is always to offer help accredited low and you will modest-income parents searching for buying its first domestic. The application provides financial help to your the brand new deposit along with the closing costs in the household get.

Few are qualified to receive this specific Program. To meet the requirements, you truly must be loans in Stepney 18 years of age or older, and get maybe not possessed possessions (otherwise had a deed on your label) for a few (3) age before the go out regarding application. You are able to meet the requirements if you are a beneficial displaced homemaker.

Homebuyer Program

The household’s earnings need to slip during the otherwise below the earnings constraints in depth toward affixed chart. Funds are merely available for those house that have a full time income in the or less than 80% of your own Median Loved ones Earnings (MFI). Additionally, people might not have closed a contract away from Selling when it comes to property before in the process of category and you may private guidance.

It’s important that you give no less than $1,one hundred thousand towards acquisition of your house. You need to also done homeownership guidance categories. Money are believed 0% desire fund, which should be paid off upon the long term business otherwise import out-of the house, unless you pick a house regarding the Revitalization aspects of Delaware Condition (look for app) whereby the mortgage try forgiven if you reside when you look at the our house to own a time period of five years. Simultaneously, the latest County will simply subordinate for the refinancing of present first mortgage to help you a lowered interest rate. New County doesn’t under when it comes down to version of home collateral or debt consolidation reduction loan and will require that all Condition money feel gone back to the new Condition upon the new settlement of every such as loan.

System Dysfunction

Purpose: To incorporate homeownership opportunities to first-time homebuyers when you look at the Delaware Condition compliment of both before and after buy homeownership counseling, as well as, deposit and you can closing pricing recommendations.

Eligible Homeowners: Reasonable and you will reasonable income (come across attached Earnings Limitations) first-time homeowners, to acquire a house in the Delaware County (to get into selection of HOFirst Teams use the hook up more than). A first time homebuyer is somebody who has perhaps not had good domestic during the last about three (3) many years, or is good displaced homemaker.

Eligible Services: Solitary family members, home-based, manager filled households (detached, dual, rowhouse, townhouse or likely. condominium) being inside compliance with State housing high quality conditions. Tenant occupied qualities, duplexes and features that will be situated in and you can shell out assets fees to help you Chester Urban area, Haverford Township otherwise Top Darby Township are also maybe not qualified.

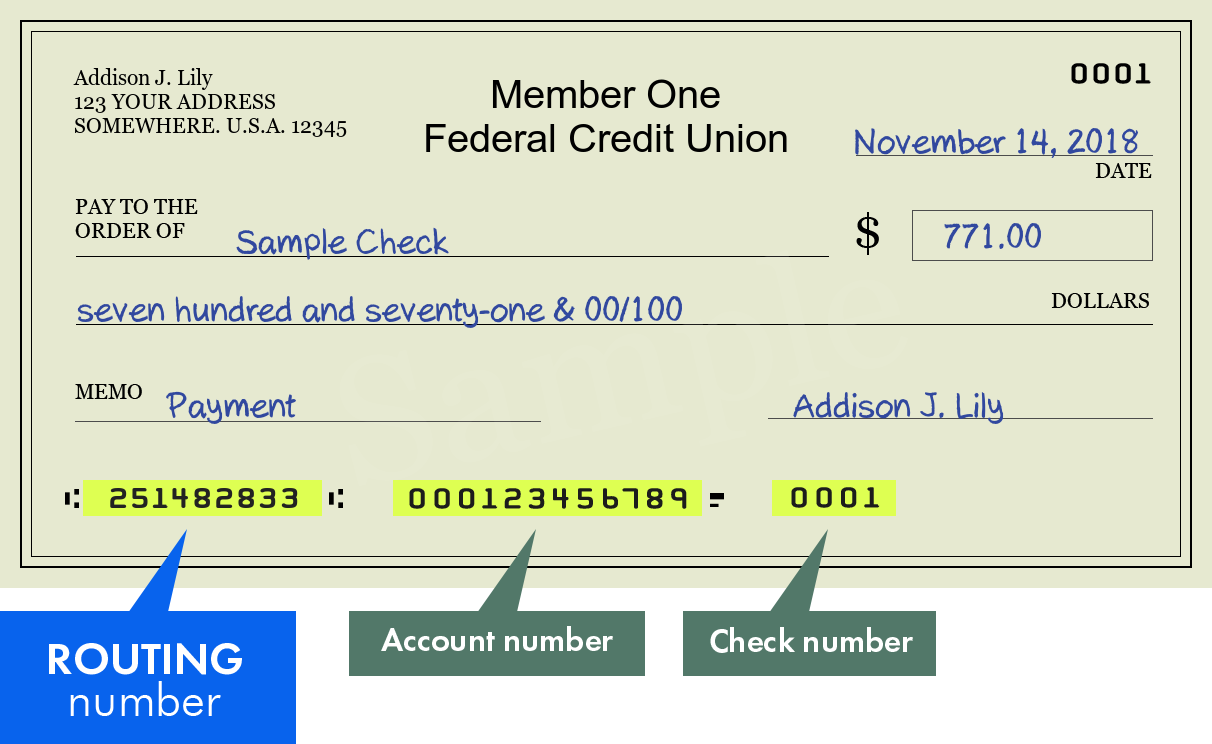

First Lenders: Applicants have to safer a first home loan. Regional banking companies or home loan businesses would be encouraged to provide discounted rates of interest and you can charges getting first-time people. First mortgages have to be 30 year fixed, at otherwise below sector rate of interest, no more about three circumstances billed, as well as have the absolute minimum 95% mortgage so you can value ratio.

Minimal Share: No less than $step one,one hundred thousand to the the acquisition of the house need certainly to come from new debtor. Usually, loan providers will demand no less than step 3.5% of transformation price regarding the borrower’s coupons. A beneficial borrower’s liquid assets, excluding senior years loans, may well not go beyond $ten,.

Homebuyer Advice: Each borrower could be evaluated based upon income, credit score, and you may offered property. Overall recommendations doesn’t meet or exceed $ten,100000. Down- commission recommendations would be restricted to a price equal to 2% of conversion process price of your house. The balance off fund would be placed on qualified closing costs as needed.

A lot more Standards: Eight (8) times away from category homeownership counseling and a minimum of one personal counseling tutorial try compulsory. A certificate off End with the effective completion of one’s homeownership guidance could well be granted as the consumer set a good credit score and you will finishes most of the activities known in their Plan.

To qualify for new Homeownership Earliest System, your existing house earnings ily Money (MFI) with the city. Remember that home earnings has the cash of all the family, to try to get yrs old otherwise earlier, that happen to be staying in the assets. The utmost terrible yearly income restrictions are listed below: